Online Giving Through OSV

Our parish is happy to provide an electronic giving option for parishioners and friends of Borgia to make contributions to the parish. This option makes use of current technology and security standards and allows you to easily setup one-time or recurring contributions. It also enables our parish to take advantage of new tools to become more efficient. Online Giving is provided by Our Sunday Visitor, a Catholic not-for-profit organization serving parishes for more than 100 years.

Online Giving Parishioner Benefits

Secure and Confidential -- No need to share payment information with the church office

Efficient -- Set up direct withdrawals from your checking, savings account or a credit card

Simple -- Start, stop and change your contributions at any time

Convenient -- No need to write a check or have cash available

Online Giving is intended to be a convenient tool for you to use, and we strongly support both Online Giving and Offering Envelopes for contributions to the parish. Online Giving is the electronic way to participate in weekly offertory. Feel free to place the "I've Given Online" cards found in the pews in the Offertory basket as a visible sign of gratitude for all that God has given you and your family.

Start Giving Online Today!

Click on the Online Giving link above.

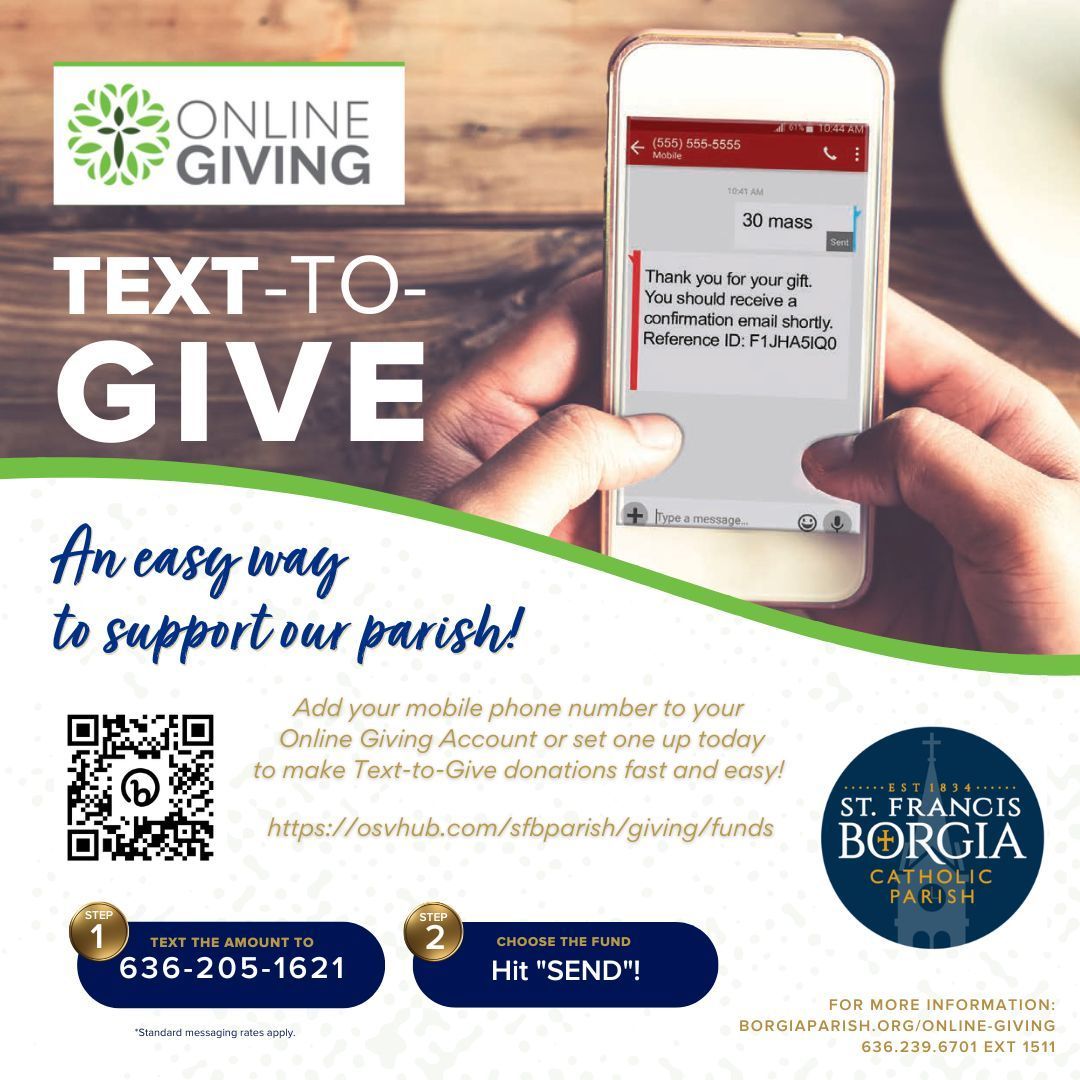

If you are new to online giving through OSV, click on the link at the top of the page to "Create Your Account". Otherwise, use your log-in credentials to "Sign In". Remember to add your mobile phone number to make the Text-To-Give feature even easier to use.

Select a fund and create your one-time gift or schedule your recurring gifts.

Have Questions?

If you have any questions about online giving, please contact the parish office (636.239.6701 ext 1511).